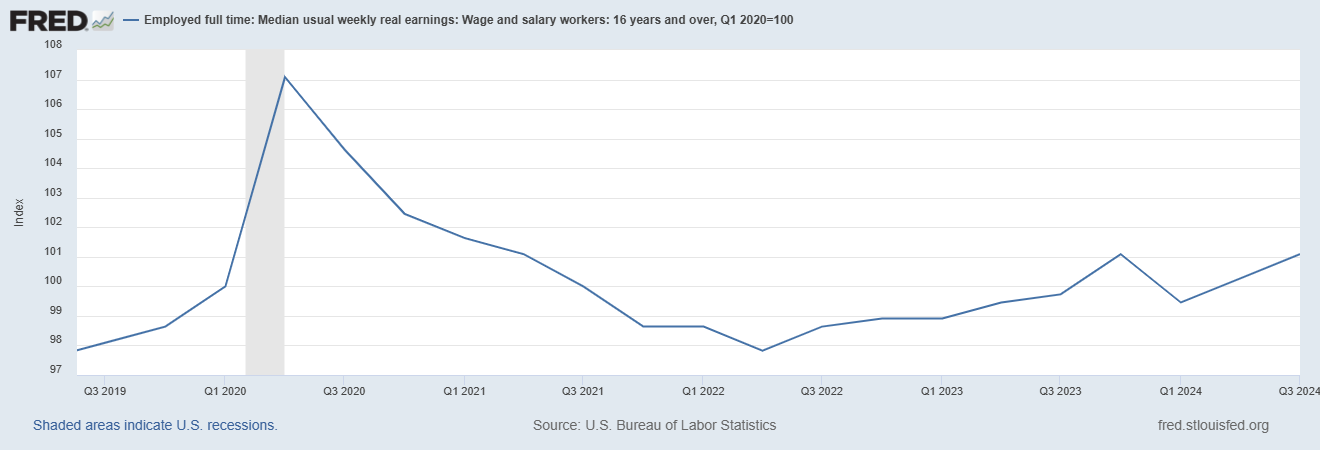

Real Median Wages Fell 2Q20 to 2Q22

I do not want to write about the election, but voters were right about inflation

Back to housing and urbanism after this, I promise.

I have resisted the urge to write about the election. I only ever predicted that it would be close, which in the grand scheme of things it still was. I did not expect Trump to win the popular vote. And I did not expect the near-universal shift toward Trump, which suggests that almost everyone hates inflation and blames incumbents for it. I am here to tell you that the voters were right. Inflation was and is real and painful.

As an aside, I did not expect this either, ostensibly an indictment of urban governance:

I had some inkling of this trend but was still surprised. Time to reset some narratives:

In advance of the election, I worried that many of my fellow YIMBYs, who mostly range from center-left to extremely progressive, would be caught off-guard if Trump won. Unfortunately it appears many were. As one leader of my YIMBY group’s parent org reflected, YIMBY may never be partisan, because NIMBYs certainly are not.

The overwhelmingly consistent shift toward Trump seems to have been driven primarily by inflation-related economic anxiety and, secondarily, anxiety about immigration and the southern border. I am an immigrant’s son. I want immigration policy to be generally permissive and hope that abundant housing will help lower the temperature of the immigration debate and make our politics more positive-sum.

Complicating this story, rising housing costs (and food prices) are surprisingly uncorrelated with how much counties shifted toward Trump. However, overall cost of living does strongly correlate with Harris locally underperforming Biden.

I have not been able to shake off the sense that many unhappy examiners of the election results are telling themselves and others an overcomplicated, self-consoling story about post-pandemic inflation and voters’ perception of it. Not to flex but as someone who researches supply chain issues in my day job, COVID-19-related supply chain disruptions were temporary and mostly operational, not structural. There are exceptions, but by now supply chains are not driving inflation, to my knowledge.

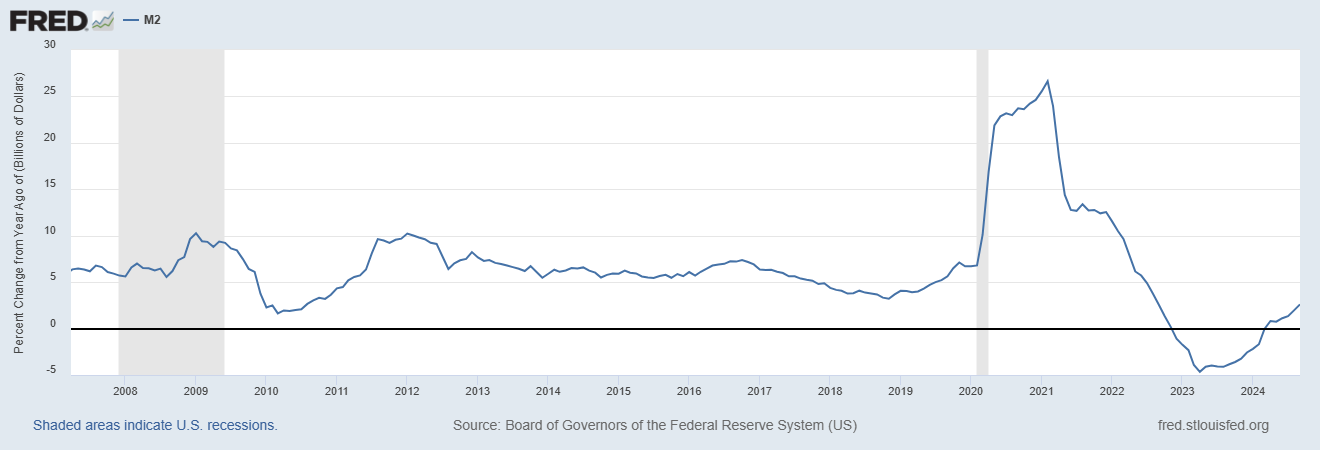

Inflation, to the extent the concept has any meaning, is ultimately a monetary phenomenon. More money enters the system, everyone has more money, prices go up, while real economic value remains largely the same. Prudent or not, the Fed’s response to the COVID-19 crisis was a historic (for the U.S.) spike of the monetary base, which is the stable component of the money supply.

Here is the percent-change of the monetary base from the prior year.

And this increase was unprecedented, dating back to at least January 1960:

What about real, inflation-adjusted wages? They fell for two years from the second quarter of 2020 through the second quarter of 2022. Real. Median. Wages. Fell.

And Biden deserves some of the blame. The White House does not and should not control the Fed, which sets interest rates and controls the monetary base and money supply. But he did sign into law the $1.9 trillion with a T American Rescue Plan Act of 2021. Was this “necessary” to “save the economy?” I cannot say, but I do know this.

When I wondered about M2 going through the roof and a stimulus bill with a price tag bigger than the GDP of South Korea, Mexico, or Australia, I was told not to worry by folks who had expertise in macroeconomics. I was told, ‘There will be no inflation. Well, OK, there is, but it is minor. Oh, wow, well inflation is pretty big, but it will be transitory. And besides, wages went up even more! People complaining about the price of groceries and eggs are just—let me just be candid—uninformed or victims of misinformation or just a little too stupid to understand these complicated issues.’

This election was a reminder that we are all the experts on our own pocketbook.

Even if we grant that inflation stats from this period could be hard to measure and unreliable, which would affect the adjustments for real wages, here is something else I know: I did not get a 20% raise since before the pandemic. I have to doubt most people did. And it looks like lots of people were out of the job market for years:

Total labor force participation is almost back to 100% of where it was before COVID-19 hit, more than four years ago. Real median wages finally caught back up in Q2 of 2024. That was right around the time Joe Biden proved what about 80% of Americans believed, that he was too old to run for reelection and preside past his 86th birthday.

There are issues voters truly do not understand well, based on a reasonable standard. They may not understand that they will pay for any new tariffs as consumers. They do not understand the big numbers in the immigration debate, as I have started to realize I do not, even though I find the story I am unearthing surprisingly comforting.

But it is political malpractice to tell people that inflation is “falling” when prices continue to rise rather than falling. Or that supply chains and complex macroeconomic forces fully explain a problem that extraordinarily expansionary monetary and fiscal policy created and made worse. And it is borderline dishonest to tell people their wages are up when in fact median wages are down or flat. Maybe Trump would have won either way. But I think I see why he won the popular vote.

Thanks to my 650 subscribers, especially my 10 paid subscribers. If you enjoy this blog or want to work together please contact lucagattonicelli@substack.com. Check out YIMBYs of Northern Virginia, the grassroots pro-housing organization I founded.

You read my mind with this post. Thanks for writing

Why focus on 2Q20-2Q22 instead of 2Q22-2Q24? Just curious.